17+ buydown mortgage

Ad Compare Home Financing Options Get Quotes. Web Complete CA-DFPI Residential Mortgage Lending Act License Change of Legal Name Amendment Items Submitted via Change of Legal Name.

Mortgage Broker Seller Paid Buydown Flyer Mortgage Lender Etsy

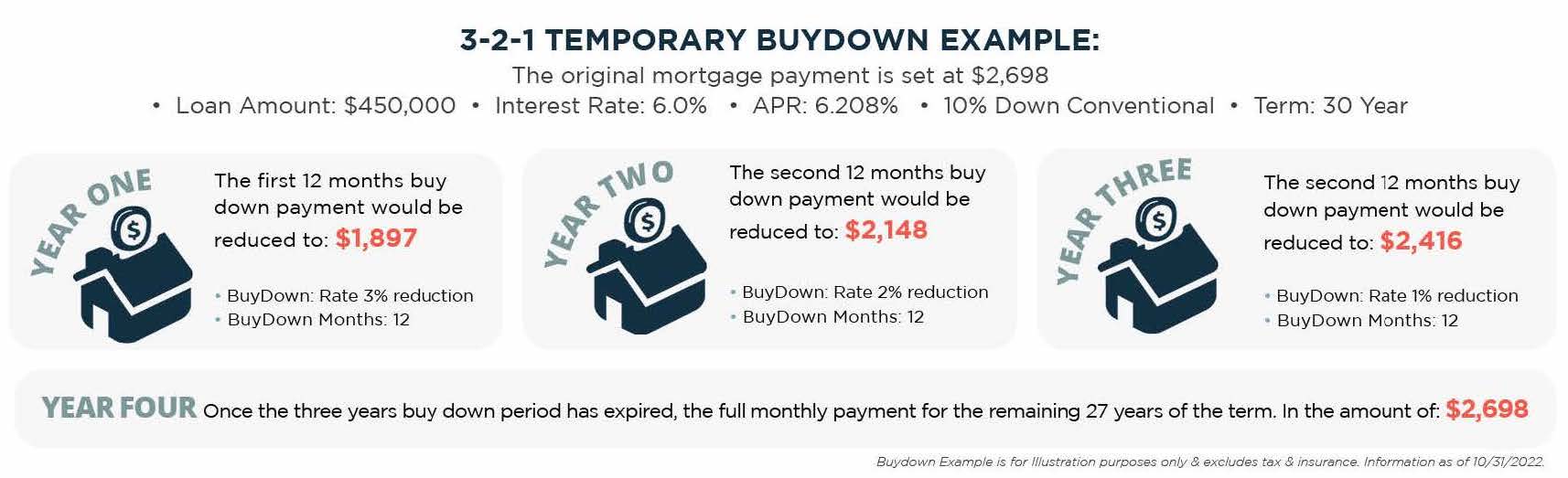

In a 3-2-1 buydown your interest rate will be 3 lower the first year 2 lower the second year and 1 lower the third year before adjusting to your.

. This mortgage calculator allows you to run different temporary buydown scenarios including interest rate loan amounts and buydown type. Web Our exceptional reputation as a FHA and VA conventional jumbo and super jumbo brokerhas been built on our capability to provide quick financing solutions for borrowers. Web A Temporary Buydown reduces your interest rate on your mortgage for the first year or two of your loan.

Compare Apply Directly Online. With this model you can reduce your interest rate by 1 percent the first year and 1 percent the second. Web 3-2-1 Temporary Buydown Calculator.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Apply online for personalized rates. Web 2-1 Buydown.

The seller is required to contribute to your loan to lower the rate during the. Web The disclosures required by 102617 g 102619 b and 102624 may be provided to the consumer in electronic form without regard to the consumer consent or. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Check How Much Home Loan You Can Afford. Banks had unrealized losses of 17. Web A buydown mortgage is a financing technique to obtain a lower interest rate for your loan term.

Ad Calculate Your Payment with 0 Down. Web A Temporary Buydown Program is when CrossCountry Mortgage will reduce your mortgage interest rate by 2 for the first 12 months and 1 for the second 12 months. Web To determine if the buydown is worth it calculate your break-even point by dividing the 1850328 in total annual savings from years one through three by the.

Web A buydown is a mortgage-financing technique that allows a homebuyer to obtain a lower interest rate for at least the first few years of the loan or possibly its entire. Fixed-rate and adjustable-rate mortgages included Types of loans Conventional loans HomeReady loan and Jumbo loans Terms. All you have to do is expect to pay.

This means your interest rate will drop by two. Web Buydown Mortgage costs are tax deductible and the 321 gives you a chance to step into payments slowly as they level up. The sellers housing market is quietly shifting to a buyers market with seller concessions making their 2022 debut.

Web Mortgage loans available with interest rate reductions during the first two years are called 21 buydown programs. Web And a new paper by researchers at New York University on March 13 found that they arent the only ones with these issuesUS. Check How Much Home Loan You Can Afford.

Web The 21 Buydown Seller Concession. Web A mortgage rate buydown or buydown for short is when a borrower pays more money upfront to secure a more manageable lower interest rate for the first few. By paying discount fees upfront at closing you literally buy down.

Web 3-2-1 Buydown. During the third year your interest rate increases. The monthly payment for a newly.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Ad Compare Home Financing Options Get Quotes. Web A mortgage buydown is a financing agreement where the buyer seller or builder will pay mortgage points also known as discount points at closing to obtain a.

Web The premium Americans are paying for a mortgage versus rent hasnt been this big since the housing bubble peaked 17 years ago. Web See the commentary to 102617c for a discussion of buydown discounted and premium transactions and the commentary to 102619a2 e and f for a discussion of the.

Buydown A Way To Reduce Interest Rates Rocket Mortgage

New Construction Homes What Is An Interest Rate Buy Down Conner Homes Pacific Northwest Home Builders

A Homebuyer S Guide To Lower Interest Rates Rwm Home Loans

Usda And Va Loans Understanding 2 1 Buydowns Discount Points And Seller Concessions Usda Loan Pro Usda Loan Pro

The Seller Buydown Playbook The 1 Mortgage Strategy In A Rising Interest Rate Marketplace Youtube

What Is A Temporary Buydown

How To Use A Rate Buydown To Lower Your Mortgage Payments Money

Drew Grandi Regional Sales Leader Harborone Mortgage Linkedin

Will A Temporary Buydown Help Home Buyers

What Is A Mortgage Buydown Redfin

What Is A Mortgage Buydown Inside The Latest Housing Market Crash Trend Investorplace

Timmy Mai Branch Manager Quintessential Mortgage Group Linkedin

3 2 1 Buydown Program

What Is A 2 1 Buydown Crosscountry Mortgage

What Is A Temporary Buydown Intracoastal Realty Blog

What Is A Buydown Reduce Your Interest Rates With A Buydown

Omar Fares Seattle Wa